The stock market is a dynamic arena where strategic investments can yield significant returns. Among the various stocks available, Adani Total Gas has garnered considerable attention from investors. As a leading player in India’s energy sector, Adani Total Gas offers a promising opportunity for both seasoned and new investors. In this comprehensive guide, we will delve into the key aspects of Adani Total Gas shares, including its market performance, future prospects, and why it could be a valuable addition to your investment portfolio.

Overview of Adani Total Gas

Adani Total Gas is a joint venture between Adani Group, a conglomerate known for its diversified business interests, and TotalEnergies, a global energy company. The company is engaged in the distribution of natural gas, serving both residential and commercial customers across India. With a strong focus on expanding its footprint, Adani Total Gas is at the forefront of India’s shift towards cleaner and more sustainable energy sources.

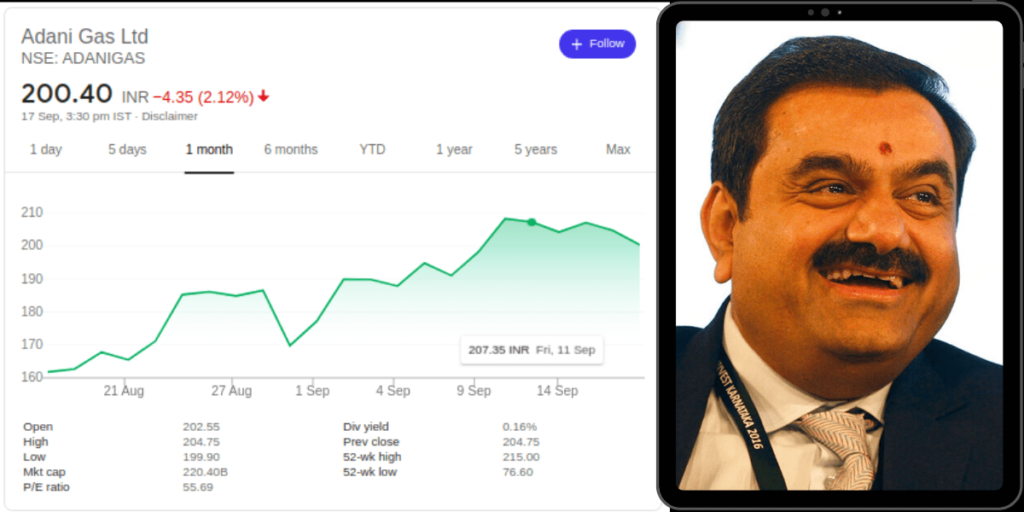

Adani Total Gas Share Performance

The performance of Adani Total Gas shares has been impressive, reflecting the company’s robust business model and growth potential. Over the past few years, the stock has shown consistent upward movement, driven by strong financial results and strategic expansions.

1. Historical Performance

Adani Total Gas has witnessed substantial growth since its listing on the stock exchange. The company’s shares have appreciated significantly, offering attractive returns to early investors. The stock’s performance is influenced by various factors, including market trends, company earnings, and sectoral developments.

2. Recent Trends

In recent months, Adani Total Gas shares have continued to perform well, even amid market volatility. The company’s commitment to expanding its gas distribution network and entering new markets has bolstered investor confidence. Additionally, the global push towards clean energy has positioned Adani Total Gas as a key player in the energy transition, further boosting its stock performance.

3. Dividend History

Investors looking for income-generating stocks will be pleased to know that Adani Total Gas has a history of paying dividends. The company’s consistent financial performance has allowed it to reward shareholders with regular dividend payouts, making it an attractive option for income-focused investors.

Future Prospects of Adani Total Gas

The future of Adani Total Gas shares looks promising, thanks to the company’s strategic initiatives and the growing demand for natural gas in India.

1. Expansion Plans

Adani Total Gas is aggressively expanding its gas distribution network across India. The company plans to increase its presence in both urban and rural areas, tapping into the growing demand for natural gas as a cleaner alternative to traditional fuels. This expansion is expected to drive revenue growth and, consequently, boost the company’s stock price.

2. Strategic Partnerships

The partnership between Adani Group and TotalEnergies is a significant advantage for Adani Total Gas. TotalEnergies brings global expertise in the energy sector, which complements Adani’s strong local presence. This collaboration is likely to lead to innovative solutions and new business opportunities, further enhancing the company’s growth prospects.

3. Government Policies

Government policies aimed at promoting clean energy and reducing carbon emissions are favorable for Adani Total Gas. The Indian government’s push for increased natural gas usage in industries, transportation, and households is expected to create new opportunities for the company. As one of the leading players in the sector, Adani Total Gas is well-positioned to capitalize on these policy-driven opportunities.

Why Invest in Adani Total Gas Shares?

Investing in Adani Total Gas shares offers several benefits, making it an attractive option for both long-term and short-term investors.

1. Strong Market Position

Adani Total Gas is one of the largest private sector players in the natural gas distribution industry in India. Its strong market position, combined with its aggressive expansion plans, provides a solid foundation for future growth.

2. Consistent Financial Performance

The company has consistently delivered strong financial results, reflecting its robust business model and effective management. This consistency makes Adani Total Gas a reliable stock for investors seeking steady returns.

3. Exposure to the Clean Energy Sector

As the world transitions towards cleaner energy sources, investing in companies like Adani Total Gas offers exposure to the growing clean energy sector. The company’s focus on natural gas, a cleaner alternative to coal and oil, aligns with global energy trends, making it a future-proof investment.

4. Dividend Income

For income-focused investors, the regular dividend payouts from Adani Total Gas provide an additional stream of income. This makes the stock an attractive option for those looking to balance capital appreciation with income generation.

Risks to Consider

While Adani Total Gas shares offer numerous benefits, it is essential to consider the potential risks associated with the investment.

1. Market Volatility

Like all stocks, Adani Total Gas shares are subject to market volatility. Factors such as economic downturns, changes in government policies, or fluctuations in energy prices can impact the stock’s performance.

2. Regulatory Risks

The energy sector is heavily regulated, and changes in government policies or regulations can affect Adani Total Gas’s operations and profitability. Investors should keep an eye on any regulatory developments that could impact the company.

3. Competition

The natural gas distribution industry in India is competitive, with several players vying for market share. While Adani Total Gas has a strong market position, increased competition could pose a challenge to its growth prospects.

Conclusion

Adani Total Gas is a compelling investment opportunity in India’s energy sector. With its strong market position, consistent financial performance, and focus on expanding its natural gas distribution network, the company is well-positioned for future growth. However, like any investment, it is crucial to consider the potential risks and conduct thorough research before making any investment decisions.

For those looking to diversify their portfolio with exposure to the clean energy sector, Adani Total Gas shares offer a promising option. As the demand for natural gas continues to rise, driven by both government policies and consumer preferences, Adani Total Gas is likely to remain a key player in the industry.

Read More Our Blogs

Adani News: A Comprehensive Overview of the Latest Developments

Adani Electricity: Powering the Future with Innovation and Sustainability