In today’s dynamic business landscape, accelerating innovation is not just a strategy but a necessity for sustainable growth. One of the key methodologies driving this acceleration is FinOps – the practice of bringing together finance, operations, and engineering to optimize cloud spending and drive business outcomes. In this comprehensive guide, we delve into Part 6 of accelerating innovation by shifting left FinOps, exploring strategies, best practices, and real-world insights to empower organizations in their journey towards financial operations transformation.

Understanding Accelerated Innovation

Defining Shifting Left in FinOps

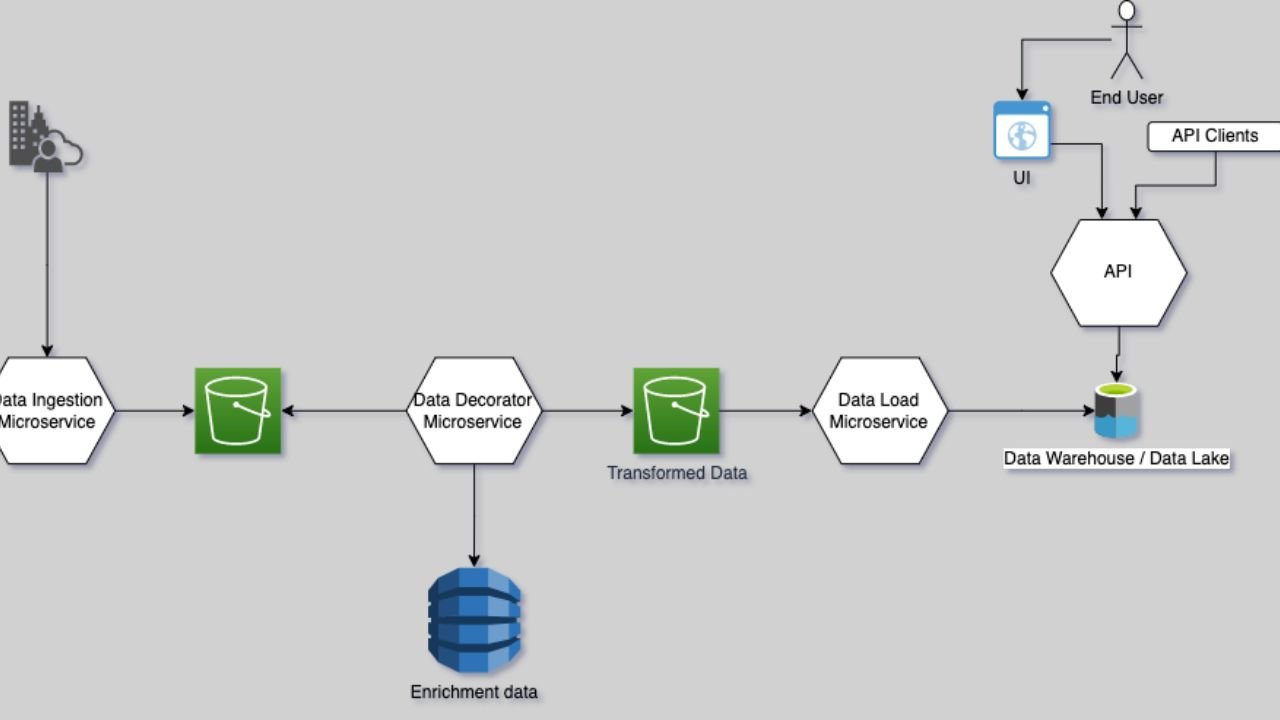

Shifting left in FinOps refers to the proactive approach of integrating financial considerations earlier in the development lifecycle, aligning financial objectives with technical decisions from the outset. By embedding financial accountability into the development process, organizations can identify cost-saving opportunities, optimize resource utilization, and enhance overall operational efficiency.

The Role of Automation in Innovation

Automation lies at the heart of accelerated innovation in FinOps. By leveraging automation tools and platforms, organizations can streamline financial processes, automate cost optimization strategies, and gain real-time insights into cloud expenditure. From automated budget allocation to predictive analytics, automation enables FinOps teams to focus on strategic initiatives rather than manual, repetitive tasks.

Implementing Shifting Left Strategies

Cultural Transformation: Fostering a FinOps Mindset

Cultural transformation is fundamental to successful FinOps implementation. Organizations need to foster a culture of accountability, collaboration, and continuous improvement across finance, operations, and development teams. By promoting transparency and shared responsibility, businesses can break down silos, facilitate cross-functional collaboration, and drive innovation at every level.

Agile Budgeting and Forecasting

Traditional budgeting and forecasting models are ill-suited to the dynamic nature of cloud environments. Agile budgeting and forecasting methodologies enable organizations to adapt quickly to changing business requirements, aligning financial forecasts with agile development cycles. By embracing iterative planning and forecasting, businesses can minimize financial risk, optimize resource allocation, and drive strategic decision-making.

Optimizing Cloud Spend

Cost Allocation and Chargeback Mechanisms

Effective cost allocation and chargeback mechanisms are essential for optimizing cloud spend and promoting accountability. By accurately attributing costs to individual teams, projects, or departments, organizations can incentivize responsible resource usage, identify cost drivers, and allocate budgets more effectively. From showback to chargeback models, cost allocation strategies empower businesses to optimize cloud spend and drive cost-conscious behavior.

Rightsizing and Instance Optimization

Rightsizing and instance optimization are critical components of cost optimization in FinOps. By rightsizing cloud resources based on workload requirements, organizations can eliminate waste, reduce unnecessary spending, and optimize performance. Leveraging instance scheduling, reservation, and lifecycle management strategies, businesses can achieve significant cost savings while maintaining scalability and performance.

Ensuring Governance and Compliance

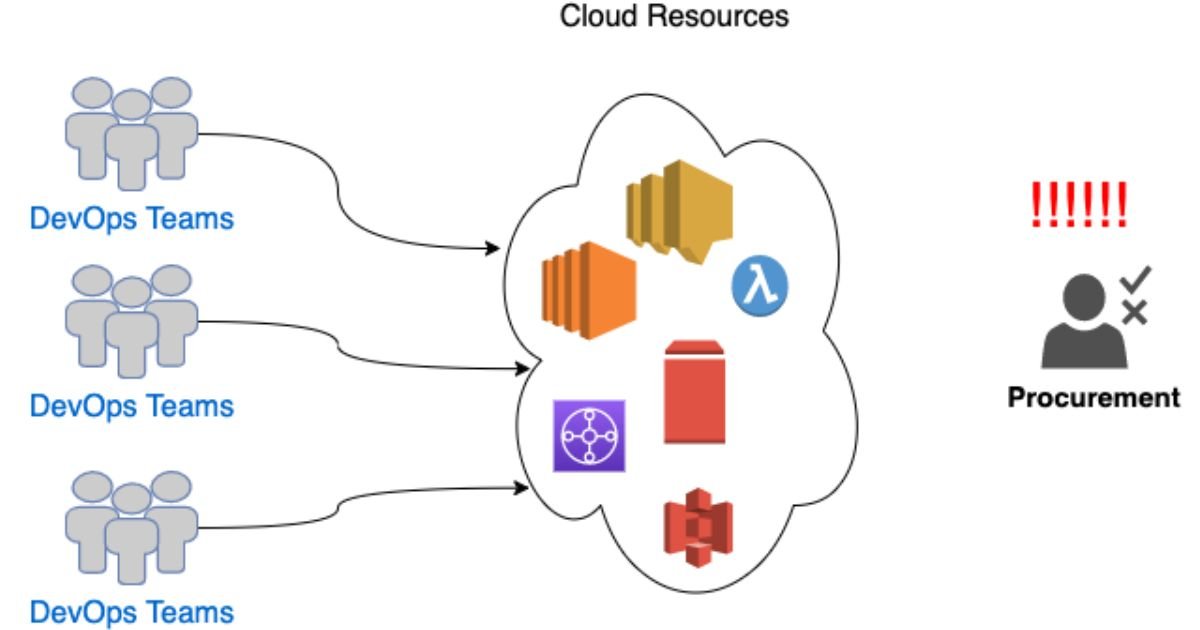

Cloud Governance Frameworks

Robust cloud governance frameworks are essential for ensuring compliance, security, and cost control in FinOps. From policy enforcement to resource tagging, governance frameworks provide the foundation for effective cloud management and risk mitigation. By implementing governance policies, organizations can enforce compliance standards, mitigate security risks, and optimize cloud spend while maintaining operational excellence.

Regulatory Compliance and Risk Management

In today’s regulatory landscape, compliance is a top priority for organizations across industries. FinOps teams need to navigate complex regulatory requirements, ensuring adherence to industry standards and data protection regulations. From GDPR to HIPAA, regulatory compliance and risk management strategies enable businesses to mitigate legal and financial risks, safeguard sensitive data, and build trust with customers and stakeholders.

Leveraging Advanced Analytics and Insights

Predictive Analytics for Cost Optimization

Predictive analytics plays a pivotal role in driving cost optimization and strategic decision-making in FinOps. By leveraging historical data, machine learning algorithms, and predictive modeling techniques, organizations can forecast future cloud spend, identify cost-saving opportunities, and optimize resource utilization. From anomaly detection to trend analysis, predictive analytics empowers FinOps teams to proactively manage costs and drive business value.

Real-time Visibility and Reporting

Real-time visibility and reporting are essential for monitoring, analyzing, and optimizing cloud expenditure. By leveraging cloud management platforms and reporting tools, organizations can gain actionable insights into resource usage, cost trends, and performance metrics. From cost breakdown analysis to budget variance reporting, real-time visibility enables FinOps teams to make data-driven decisions, optimize spending, and drive continuous improvement.

Accelerate Innovation by Shifting Left FinOps: Part 6

Empowering Financial Operations Transformation

Accelerating innovation by shifting left in FinOps is not just about optimizing cloud spend; it’s about empowering financial operations transformation and driving business agility. By integrating financial considerations early in the development lifecycle, organizations can align financial objectives with strategic initiatives, optimize resource utilization, and fuel innovation at scale. From cultural transformation to advanced analytics, Part 6 of this series explores the key strategies and best practices for unleashing the power of financial operations transformation in the digital age.

FAQs

What is the primary goal of shifting left in FinOps?

The primary goal of shifting left in FinOps is to integrate financial considerations earlier in the development lifecycle, aligning financial objectives with technical decisions from the outset to optimize cloud spending and drive business outcomes.

How does automation contribute to accelerated innovation in FinOps?

Automation streamlines financial processes, automates cost optimization strategies, and provides real-time insights into cloud expenditure, allowing FinOps teams to focus on strategic initiatives rather than manual tasks.

Why is cultural transformation essential for successful FinOps implementation?

Cultural transformation fosters a culture of accountability, collaboration, and continuous improvement, breaking down silos and promoting cross-functional collaboration across finance, operations, and development teams.

What are the key components of cloud governance frameworks in FinOps?

Cloud governance frameworks encompass policy enforcement, resource tagging, compliance standards, and risk mitigation strategies, ensuring security, compliance, and cost control in cloud environments.

How can organizations leverage predictive analytics for cost optimization in FinOps?

Predictive analytics enables organizations to forecast future cloud spend, identify cost-saving opportunities, and optimize resource utilization through historical data analysis, machine learning algorithms, and predictive modeling techniques.

What role does real-time visibility and reporting play in FinOps?

Real-time visibility and reporting provide actionable insights into resource usage, cost trends, and performance metrics, enabling FinOps teams to make data-driven decisions, optimize spending, and drive continuous improvement.

Conclusion

In conclusion, accelerating innovation by shifting left in FinOps is a multifaceted endeavor that requires a strategic approach, cultural transformation, and advanced analytics capabilities. By integrating financial considerations early in the development lifecycle, optimizing cloud spend, and ensuring governance and compliance, organizations can unleash the power of financial operations transformation, driving business agility, and fueling innovation in the digital age.